What is a commodity super cycle?

A commodity super cycle refers to extended periods, often spanning decades, during which the prices of many primary commodities, including metals, energy resources, and agricultural products, remain above their long-term price trend. The reasons for a super cycle can vary but are typically a result of prolonged demand increases outpacing supply or significant shifts in macroeconomic conditions.

The price of fuel and its impact on the commodity super cycle

Fuel, especially oil, is a critical input in the production and transportation of nearly all goods and services. Here's how rising fuel prices can affect other commodity prices:

- Transportation Costs: Fuel is a major cost component for transporting goods. When fuel prices rise, transportation costs also rise, leading to higher costs for commodities that rely on transportation, such as agricultural products or imported goods.

- Production Costs: Many industries use fuel directly in the production process. For instance, agriculture relies on diesel for tractors and machinery. Higher fuel costs can translate to higher production costs, which can push up the prices of these commodities.

- Substitution Effects: When the price of one energy source (e.g., oil) rises significantly, demand might shift to alternative sources (e.g., natural gas, coal). This can drive up the prices of those alternative commodities.

- Inflationary Pressures: Prolonged periods of high fuel prices can lead to general inflation, pushing up the prices of many goods and services, including commodities.

- Reduced Discretionary Spending: Higher fuel prices can reduce the amount of money consumers have to spend on other goods and services. This can have a dampening effect on demand for certain commodities, potentially impacting their prices.

How fuel prices increase the cost of agriculture

When fuel prices go up, it becomes more expensive to gather other resources. This in turn makes agriculture more difficult and thus food prices will increase. Imagine trying to run a farm with increasing energy costs. It is not only difficult to grow food to feed a family, but without those extra metals extract from the earth, it becomes difficult to build a house to live as well.

While electric vehicles and solar panels for homes can help, those technologies are not ready yet to replace the supply of fuel from oil. Fuel is still essential for an industrial society to produce enough raw materials for houses and agricultural products for food.

Our prediction for the commodity super cycle

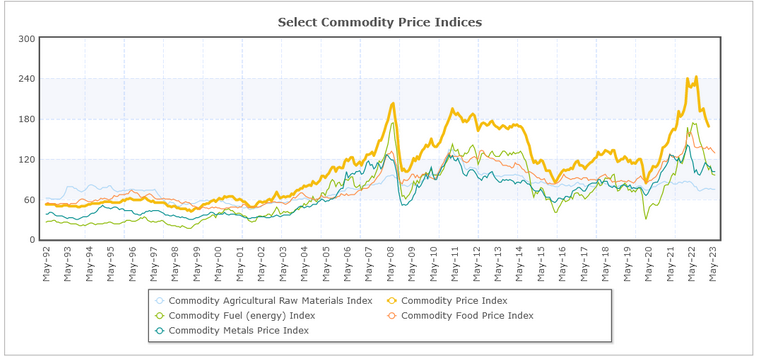

So according the commodity super cycle theory, the last bottoming of commodity prices was in 1996. This means that the next CSC should start sometime after 2016. It could even be 10 years late as previous CSC have been 29-33 years long. So maybe we have hit the bottom price for commodities, or it will be coming soon.

Looking at the above chart. Commodity prices are coming down from a short peak, and are around the same levels as in 2016. Either prices will continue to go down, or we have hit a “double-bottom” in commodity prices and the next commodity super cycle will begin soon.

The effect the commodity super cycle on the global economy

The world be fine, it’s just half the people living in it will be facing some difficulties and we can expect wars over resources in Africa and the middle-east. Developing countries with resources could experience and economic boom for 10-16 years if they manage to liberalise their economies, such as India. Countries whose economies are based on services and import most of their food will experience a terrible ‘cost-of-living’ crisis.

Proposed solution

While we cant really wave a magic wand and start investing in commodities and expect prices to go down tomorrow, we can however start planning for the future and reverse the upward trend of commodity prices in a few years time.

“Investment” is the wrong word, but we do need rapidly increase our fuel sources, build houses for a crowded world and try revive the agricultural industry in western countries that rely way too much on “big tech” for economic growth.

Small European countries like Ireland cannot not fit anymore big tech companies on the power grid. Too much food is imported from abroad, which as previously said, will be effected by the price of fuel. Ireland really needs increase fuel, agriculture and housing production, or another decade will be lost.

References

Visual Capitalist - What is a Commodity Super Cycle?

https://www.visualcapitalist.com/what-is-a-commodity-super-cycle/

Index Mundi - Commodity prices

https://www.indexmundi.com/commodities/

Our World in Data - Global commodity prices

https://ourworldindata.org/grapher/global-commodity-prices-19602019