The 4-year Bitcoin super cycle is a concept that is largely tied to the Bitcoin halving event. The halving is a feature built into Bitcoin's protocol by its creator, Satoshi Nakamoto, to control inflation by reducing the rate at which new bitcoins are created. Here's an explanation of how this cycle works and its connection to the market's bull runs:

The Bitcoin halving event

1. What is Bitcoin Halving?

- Approximately every four years (or more precisely, every 210,000 blocks), the reward that Bitcoin miners receive for adding a block to the blockchain is cut in half. This is known as the "halving" or "halvening."

- When Bitcoin first started, the reward was 50 bitcoins per block. It halved to 25 in 2012, then to 12.5 in 2016, then to 6.25 in 2020, and will continue to halve at this pace until the maximum supply of 21 million bitcoins is reached.

2. Impact on Supply:

- The halving reduces the rate at which new bitcoins are generated, thereby slowing down the supply growth. This is similar to a company conducting a stock buyback to reduce the number of shares available in the market, potentially increasing the value of remaining shares if demand stays constant or grows.

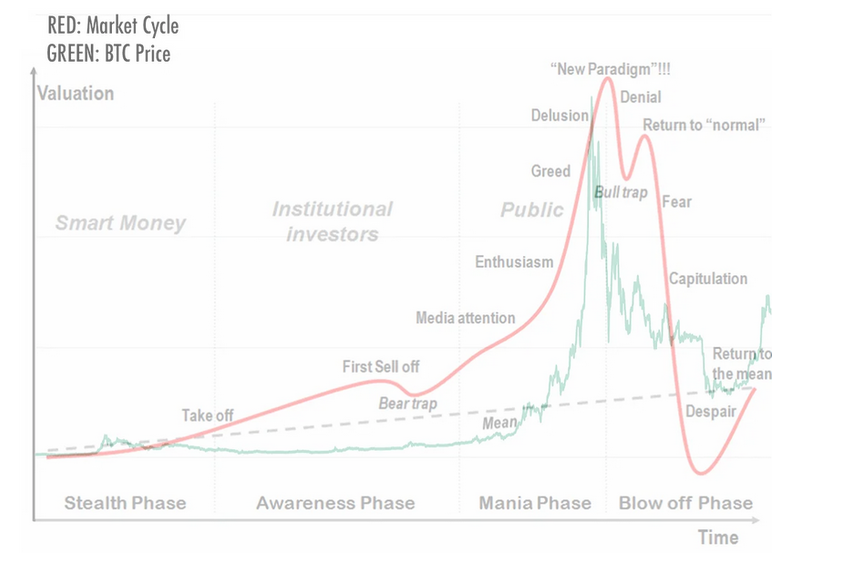

The Bitcoin Super Cycle Theory

1. Reduced Supply, Same or Increased Demand:

- The super cycle theory posits that because each halving reduces the rate of new Bitcoin creation, if demand remains the same or increases, the price should go up. This is basic supply and demand economics.

2. Historical Precedent:

- Historically, each halving event has been followed approximately a year later by a significant bull run. This pattern has led to speculation and prediction based on the timing of the halving events.

- For instance, after the 2012 halving, Bitcoin's price increased significantly in 2013. Similarly, the 2016 halving was followed by the 2017 bull run. In 2020, the reward halved again, and a year later, Bitcoin reached a new all-time high.

Predicting Bitcoin Bull Runs

By looking at how long it's been since the last halving, some investors attempt to predict when the next bull run might happen. Based on the 4-year cycle, one might expect a bull run to occur roughly a year after a halving event.

Bitcoin Super Cycle Conclusion

Bitcoin's 4-year super cycle is a compelling narrative that aligns with the halving events and the subsequent impact on supply and demand. As described here before, we can follow a dollar cost average strategy based on the Bitcoin Super-Cycle Theory to sell off our gains during the bull-run. Thus we may protect our savings from inflation and make a profit from buying Bitcoin every four years.

It is the view of Decade Of Data that as of December 2023, the price of Bitcoin might go down during the winter, but the new bull-cycle will start after the Bitcoin Halving event in 2024. Thus it is time to buy Bitcoin and sell at the end of 2025.