We will assume the mind of a low-income beginner that can save a small amount of $200 per month. Later we can learn more about market-cycles and go for a more advanced strategy that starts in the bear market and sells off during the bull market.

What is Dollar-cost-averaging?

Take a recent example. Last month we bought Hive, the price went down and we bought more Hive this month. After the bank run started, Hive went back up. So instead of a loss, we gained the benefit of the averages. Our profit is like we had bought at price in between these two months.

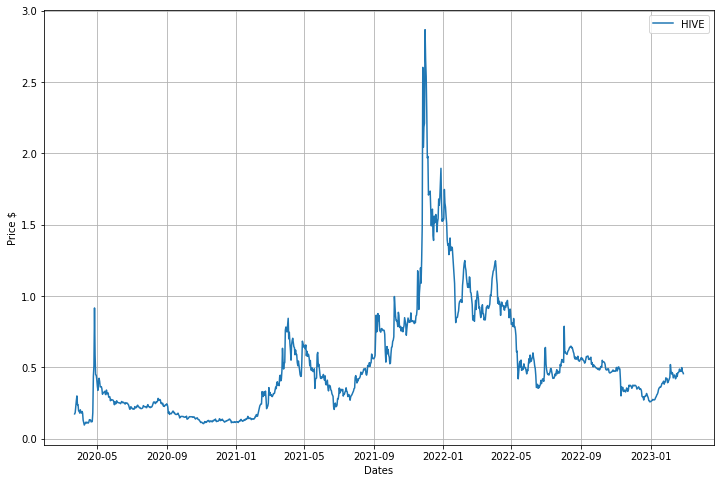

Hive price-history

As we can see from Hive’s price-history, it came into existence in 2020 and its price momentum followed Bitcoin’s price momentum. When Bitcoin peaked in 2021 and went down for two years, Hive also peaked in 2021 and went down for two years.

If we are confident in the development of Blockchain technology in the near future, we can guess we will experience a similar market-cycle that spikes every four years. Thus we can save $200 per month and hope that it will pay off in the future.

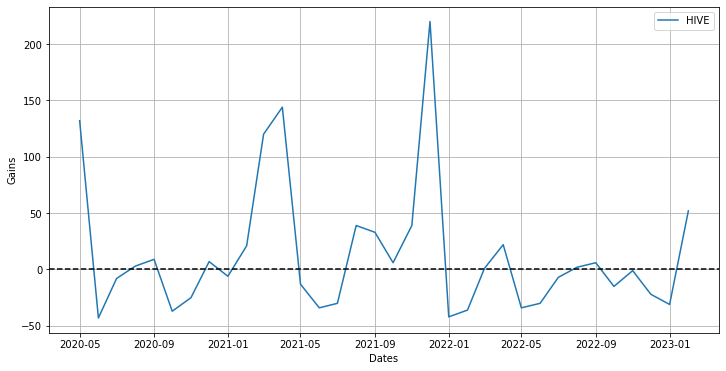

Monthly gains from dollar-cost-averaging

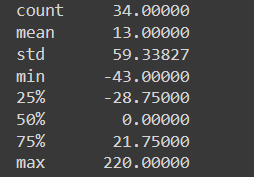

If we take the mindset of a gambler, and guess what our monthly gains will be from past performances, we can see that in this dataset exactly half the time our gains are positive and half our gains are negative. The large gains outweigh the small losses, and thus average out at 13% gain per month. These are much better odds than a game at a casino, and it is enough to offset normal levels of inflation.

Our profit from dollar-cost-averaging

If we set up a standing order with Binance, to purchase $200 of Hive per month during this time period: we would have acquired 21805 Hive. This amounts to $8639.30. Since we invested a total of $6,800, our overall profit is $1839.30.

Our gain over the past 3 years has been 27%. This is enough to offset inflation over a long period of time. Our example here is for a low-income person, but also anyone investing large sums of money will experience the same percentage gains, with obviously larger amounts of profit.

The advanced strategy

For a beginner, it’s grand to start off slowly and steadily build a crypto-savings account. The more advanced strategy would be to actually learn how markets work and learn technical analysis.

While technical charts just look like a bunch of squiggles; the MACD and Stochastic RSI gives us two buy signals, and the Triple MA gives us a sense of what direction the momentum will take. So we didn't buy a hive at the start of the month, we waited for the price to go down and bought after we receive our buy signals.

Trading with technical analysis is like educated gambling, but it can work for people. So the advanced strategy is like the DCA but adjusts the timing according to the market. Then sell off crypto during the next bull-cycle to maximise profits.

To master this could take years.

Conclusion

As long as we believe that the blockchain economy will grow over time, buying crypto once a month for the next 2 years will most likely off-set the inflation we are experiencing at the moment. A beginner may feel like this is gambling at the start, but we can learn the rhythm of the market cycles to maximise our profits.

Luckily Binance offers DCA services by setting up an automatic purchase crypto from our bank account every month.